10 Paradoxes That Will Bite You in the Ass (1st in Series)

September 3, 2018 Written by: W.B. “Bud” Kirchner

Approx Read Time: 6 Minutes

“Many complain of their memory, few of their judgement.” – Benjamin Franklin

Paradoxes & Background

I expect I have written dozens of articles that illustrate paradoxes related to the disconnect between neuroscience/psychology and business (see bibliography for select references).

These have been somewhat detailed in nature so likely not on the tip of your tongue. Given the impact of succumbing to a paradox (and at the request of some regular readers), I have prepared the “definitive” list of paradoxes that you are likely to deal with. Incidentally, rather than paint paradoxes as all doom and gloom – I would remind the reader of the ‘silver lining’ there is nothing like a paradox to create humility.

So as to not overwhelm anyone, I will present these in small (‘bite-size’) batches over a few articles. The first in the series focuses on the (false) belief that we are rational beings and without fail, make unbiased decisions.

Introduction

“Life is the sum of all your choices.” – Albert Camus

There are numerous articles on the Business Brain Model to date (but with more to come) dealing with the reasons behind this “decision making” paradox – including what the implications are. The biggest challenge is focusing on the most relevant to this discussion.

Perhaps the best way to illustrate how this paradox works (as in “bites you”) is with a cross section (in summary form) of (just some) of the errors/biases that I have discussed in various articles.

As always, I have tried to simplify (oversimplify?) the content so as to make it quickly digestible. For example: biases are not necessarily irrational (but can still be problematic).

For those that question, how can this be? I remind you (from article “Arming Yourself in the Battle with Your Mind Thinking Errors: Part Four”), our brain today, for all practical purposes, still carries programming for a world we no longer live in.

What Bites You

“The straight line; a respectable optical illusion, but one that ruins many a man.” – Victor Hugo, Les Miserable

The following list, while not complete, illustrates the depth and breadth of the errors/biases that prevent us from making rational and unbiased decisions. Think of the following as snippets overheard from a conversation involving Kahneman/Thaler/Ariely etc. Proper references are available in my previous articles.

You will note that the categories are subjective. Again, I stress (sadly) this is far from a complete list.

Statistics

- Complications generated by the almost universal misunderstanding of statistics

- Confusing correlation with cause and effect

- Treating opinion as fact

- Confusing relative vs. absolute risk

- Constrained by boundaries set by others

- Good at judging absolute values but prefer to compare values and benefits

Philosophy

- Not being able to prove something is wrong does not mean it is right

- Thinking glass is always half full

- Thinking in absolute terms

- A positions merit does not depend on how many hold it

- People will penalize unfair behavior even if they do not benefit from doing so

- Something must be right because someone has put so much sincere good work into it

- Do not want to be seen as different

- Disregarding how unpredictable life is

Memory

- Unusual events are better remembered than usual ones

- Nobody ever caught a fish as big as they remembered

- Forget unpleasant events quicker than pleasant

- Almost everyone almost always “knew it all along” – called 20/20 hindsight

- Failure blamed on external forces while success attributed to internal forces

- We underestimate everything from CAPEX projects to the value of acquisitions

- Familiarity is interpreted as validity

Behavioral Economics

- Nobody understands how to determine utility value

- We are bad at estimating both value and odds

- We are suckers for the default position

- We think value is based on what we compare an item to

- Loss aversion is more important than gain perception

- Behavioral decisions are not made independent of the context

- We tend to focus on instant gratification

- We give losses more weight than gains

- We are most interested in relative gains and losses rather than final worth

- We refuse proceeds if we don’t feel we receive our fair share

- We relate to quantitative statements even when they are designed to pull us in a counterproductive direction (priming) and when they have no relevance to the matter at hand (anchoring).

Heuristics

- Labeling things give credibility (I can’t help but think of a blog using ‘brain’ in the title)

- Basing a decision on an emotional reaction (affect)

- Emotions distorting view of world

- Focus on obvious solution/cause

- Mistake from action hurts more than inaction

- You get what you pay for

- Levels of stress could have a negative impact on optimal, rational decision making

- The fallacy of attempting to refute an argument by attacking the opposition’s personal character or reputation

- We look for support for our view. We avoid anything that creates cognitive dissonance

- “If it ain’t broke, don’t fix it”

- Attribute positive events to personal characteristics but negative to external

Social

- Success has many fathers – failure is an orphan

- Overly personalizing success or failure

- Distorting issues – answer the question you have an answer to, not the one you are asked

- Shifting comparisons

- Overgeneralizing from isolated cases

- We avoid individuals who are “different” – negative consequences of oxytocin?

- We think everyone sees the world and has same preferences we do

- We are reluctant to abandon initiatives

- We prefer certainty and are willing to sacrifice gains to achieve more certainty

How to Avoid Being Bitten

“An expert is someone who has succeeded in making decisions and judgments simpler through knowing what to pay attention to and what to ignore.” – Edward de Bono

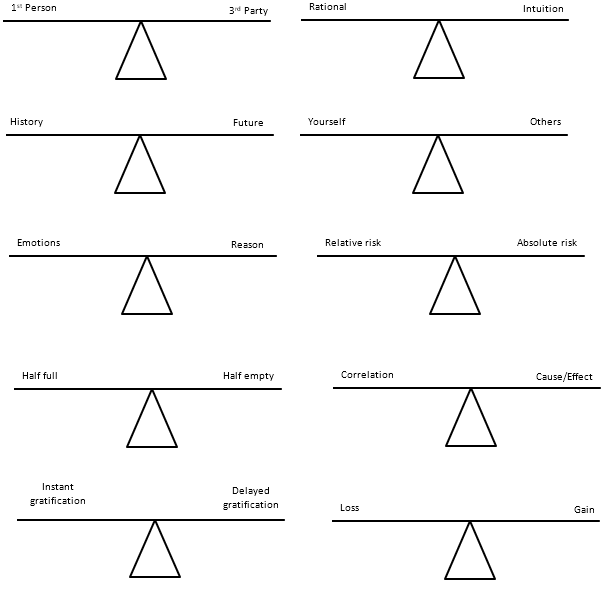

Surprise, surprise – it is a lot easier to recognize the bites from thinking errors/biases than it is to know what to do about them. However, I would like to share with you a unique protocol that we have developed at Kirchner Group. The essence of this is what we call the ‘balance paradigm’. As illustrated by the following diagram (which shows just some examples) we look at alternatives from opposite directions to attempt to “balance” the decision in light of all the errors/biases that come to bare. Obviously, this is less a solution and more a disciplined approach.

In the context of nothing is simple – we employ this approach – mindful that the more time we spend the more our willpower (energy) is depleted (thus further exacerbating the dynamics) so time is of the essence.

Balance Paradigm: Select Illustrations

“Good decisions come from experience, and experience comes from bad decisions.” – Author Unknown

Conclusion

“It’s not hard to make a decision when you know what your values are.” – Roy E. Disney

As is always my objective – the takeaway is simple: responsible decision making (especially in business) involves (1) an awareness of the ‘facts’ that seem to be irrefutable and (2) a balance between the polar positions.

Bibliography

- Dan Ariely – Predictably Irrational – The Hidden Forces That Shape Our Decisions

- Daniel Kahneman – Thinking, Fast and Slow

- Richard H. Thaler – The Winner’s Curse: Paradoxes and Anomalies of Economic Life

Relevant Business Brain Model articles:

- “I’ve lived through some terrible things in my life, some of which actually happened” – Mark Twain

- Happy Birth Year, Henry David! Thank You For the Gift

- Paradoxes To Live By

- Deciding How to Decide to Make Decisions

- Thaler Explained Why It Makes Sense That Things Don’t Make Sense

- Rapport: Part Two – Your “How To Guide” to Building Rapport

- Passion: Part Two – How to get Intimate with Your Passion

About the Author: W.B. “Bud” Kirchner is a serial entrepreneur and philanthropist with more than 50 years of business success. He is not a scientist or an academic but he does have a diversified exposure to neuroscience, psychology and related cognitive sciences. Generally speaking, the ideas he expresses here are business-angled expansions of other people’s ideas, so when possible, he will link to the original reference.